The contribution of an intellectual property right to the capital of a company is a well-founded and advantageous act of management. This strategy allows, among other things, to strengthen equity and consolidate the financial structure of your company.

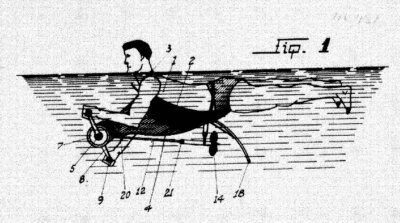

The financial valuation of the intangible asset that will be contributed is a mandatory step prior to the contribution transaction. It must be carried out by an expert which will be the interlocutor of the appointed contributions auditor and will assume responsibility with him.

In France, the tax on capital gains applicable when an industrial property right is contributed in kind to a company is not uniform. In the event of the contribution from an individual to a company or the contribution from a company to another company, taxation varies depending on the nature of the contributor and also, depending on whether it is a patent, a software, a trademark, a domain name, or any other intangible asset.

Do not hesitate to contact us to know more.

Also available on our website: