Companies can experience hard times which can lead them to bankruptcy, or even to liquidation.

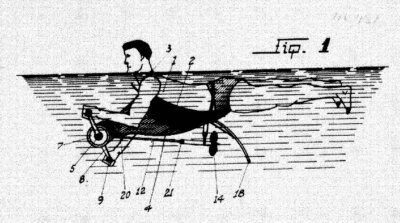

The valuation of a company which takes into account its intangible assets whatever their nature (patents, trademarks, software, etc.), duly attested by a contributions auditor, gives the company an objective value which allows it to consider a fundraising or an industrial and financial backing (opening up of the capital), or to get an asset-backed loan, thus avoiding bankruptcy or worse…

In case of bankruptcy, a company that holds non-valued intellectual property rights can, with the contribution of an appointed agent, proceed to the valuation of its intangible assets and, on this basis, sell them, pledge them or open up its capital to new investors.

In conclusion, building an intellectual property portfolio allows a company to increase its value and, in the event of an accident, to have a backup solution, thanks to the valuation of its intangible assets, and help its rebound.